Ready to start?

Belleville drivers can save an average of $300 on insurance with BIG.

Driving in Belleville

Belleville’s well-connected roadways make commuting and travel convenient. Major routes like Highway 401 provide access to Toronto, Kingston, and Ottawa, while Highway 62 and Highway 37 link the city to nearby communities such as Prince Edward County and Tweed.

Whether you’re making your way to Loyalist College, heading to the Quinte Mall, commuting to work, or heading out on a road trip, having reliable auto insurance will allow you to enjoy the journey ahead. If you need assistance in choosing the best coverage for your situation, a BIG car insurance broker in Belleville can offer expert advice so that you can drive with confidence wherever the roads take you.

Join the Hundreds of Thousands Who Have Trusted BIG

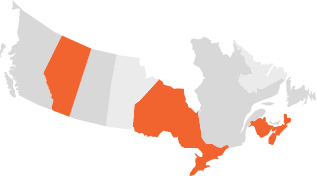

National Insurance Brokerage

Finding the best rates and coverage for Canadians in:

- Alberta

- Nova Scotia

- New Brunswick

- Ontario

Professional Service

Our team of experienced brokers will provide outstanding customer service and are dedicated to helping you find affordable auto insurance quotes in Belleville.

Access to a Large Array of Trusted Insurance Providers

How to Request an Auto Insurance Quote in Belleville

Explore your options for insurance and secure a policy in three easy steps:

Fill Out Our Quote Form

Enter details like your postal code, age, vehicle make and model, driving history, and insurance information into our quote form.

Customize Your Coverage

After you submit your request, a BIG broker will contact you to review your information and create a customized car insurance policy.

Complete Your Insurance Application

Once you’ve selected your coverage, sign your digital insurance application so you can secure your rate and hit the roads of Belleville.

Find a Belleville Brokerage Near You

Belleville

81 Dundas Street E.

Belleville, ON K8N 1B9

FAQs About Belleville Auto Insurance

The cost of car insurance in Belleville is different for every driver. Your premium will depend on factors such as your driving history, age, vehicle type, and coverage preferences. Other elements, like where you live in the city and how often you drive, also impact your premium. To get a better idea of how much you will pay, you can request an online insurance quote for Belleville today.

Yes, it is a legal requirement to have auto insurance in Belleville, and all policies must meet the province’s minimum coverage standards. Driving without it is illegal and can result in fines, licence suspension, and even vehicle impoundment. If you are caught driving without insurance, insurance providers might charge you higher premiums or refuse to offer you coverage when it’s time to renew.

Car insurance tends to be less expensive in Belleville compared to other cities in Ontario. However, rates vary based on individual factors. Working with a broker can help you access affordable car insurance quotes for Belleville.

Getting started is simple. Visit our website and request a quote for car insurance in Belleville to explore your coverage choices, or connect with a BIG broker for expert guidance in finding a policy that fits your needs and budget.

Yes, you can get car insurance quotes before purchasing a vehicle. In fact, comparing quotes in advance can help you understand potential costs for different types of vehicles and make a more informed decision.

To get a quote, you’ll need to provide details such as your postal code, age, gender, and contact details, as well as specifics about the vehicle you plan to insure (i.e. make, model, and year). You’ll also need to share your driving history, previous insurance coverage, claims, and any traffic tickets.

There are many ways you can save on insurance. From bundling policies and reducing your driving to installing winter tires and anti-theft devices, a BIG broker can help you discover opportunities to lower your premium.

Your policy will begin as soon as possible. If you are hoping to have your policy start by a certain date, let your broker know. This is especially helpful if you’re switching providers or purchasing a new vehicle.

How Belleville Vehicle Insurance Premiums Are Calculated

Insurance providers take many factors into account when calculating your premium. This leads to prices that are unique to everyone based on their individual risk profile. Here’s a breakdown of how they affect the price you pay for insurance.

Where you live in Belleville can affect your insurance rates. Insurers assess neighbourhood factors like traffic congestion, accident statistics, and crime rates to gauge your level of risk. Areas with fewer accidents and lower theft rates may benefit from lower premiums.

Your age, gender, and marital status influence how insurers calculate your risk level. Younger drivers and males tend to have higher premiums due to statistical driving behaviours, while married individuals may receive lower rates as they are considered more responsible drivers.

A clean driving history with no accidents or traffic violations can help reduce your premium. More years of driving experience and a safe track record demonstrate lower risk to insurers, leading to better rates.

The longer you have maintained continuous coverage without claims, the better your chances of securing lower rates. However, frequent claims can signal higher risk and potentially increase your premium.

Your car’s make, model, age, and safety features all contribute to your insurance costs. High-performance vehicles, luxury cars, and models with high repair costs generally lead to higher premiums, while safe, reliable vehicles may help you save.

The more you drive, the higher your chances of being involved in an accident. If you have a long daily commute or drive frequently, this will likely have an impact on how much you pay for insurance.

Choosing basic coverage can help keep costs down, while optional coverages like collision, comprehensive, or accident forgiveness will increase your premium. That said, these optional forms of insurance will offer greater protection in the event of a claim.

How to Save on Car Insurance in Belleville

Looking for ways to save on auto insurance? Here are some practical strategies to help you secure better rates without compromising on coverage.

Get Expert Advice from a Broker

A broker can help you find the best car insurance in Belleville for your situation. They’ll ensure you don’t overpay for unnecessary coverage and get the protection you need.

Bundle Your Insurance Policies

Combining your auto insurance with other policies, like home insurance, can lead to valuable discounts. Many insurers reward clients who bundle, making it a simple way to cut costs.

Take Advantage of Winter Tire Discounts

Belleville’s winters can be unpredictable. Installing winter tires can improve road safety and help you save at the same time. Ask your broker to learn more!

Maintain a Clean Driving Record

Safe driving habits pay off. Avoiding accidents and traffic violations keeps your record clean, which can lead to lower premiums over time.

Ask About Available Discounts

From group discounts to savings for good students, there are plenty of ways to access lower premiums. Check with your broker to see if you qualify for any of these opportunities.

Reduce Your Mileage

Driving less can have a positive impact on your premium. Insurance providers often offer lower rates to drivers with lower annual mileage, as it reduces the risk of accidents and claims.

The Latest

Check out our latest blog posts on all things auto insurance…