Determine the Best Term Life Insurance for You

Friday, 19 October 2018

Unlike health insurance, which pays out when you get sick, life insurance pays a tax-free cash benefit to your beneficiaries when you die. In this article we will be looking at term life insurance which provides protection over a pre-defined period. When comparing whole or term life insurance, cost is a huge factor. Term Life Insurance is a relatively lower cost form of life insurance that naturally gets more expensive as you get older. This is because you become higher risk to insure. Term Life Insurance does not accumulate cash value but is a much lower cost than whole life insurance. This can be around 10 x lower!

Unlike whole life insurance, term life insurance is limited to a certain number of years. This allows you to insure a certain period of your life that may be more imperative to have additional protection. Typically, you would choose to purchase this temporary insurance to protect your dependents when you may have significant financial obligations such as a mortgage. This protection would prevent your family from experiencing real financial hardship if you died.

Deciding Between 10-Year or 20-Year Term Life Insurance

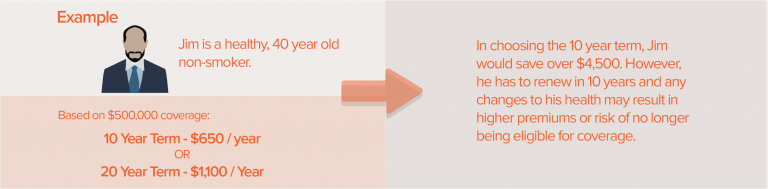

As the name suggests, 10-Year or 20-Year Term Life Insurance lasts for a limited number of years. 10 Year Term Life Insurance has a lower premium so is often more affordable. This is the ideal choice if your need is unlikely to extend beyond the 10-year term. On the other hand, choosing 20-year term life insurance tends to be more expensive. But, you are guaranteed coverage for 20 years as long as you pay the premium. This is often enough to cover mortgage payments, raise children and develop a stronger financial foundation.

Factors to Consider When Choosing 10 Year Term Life Insurance

Some people will opt for the 10-year term life insurance as they want the lower premium. However, once the term is over, you will have to renew if you you still have a requirement for coverage. Renewal will often result in an increase in premium. This can potentially be more than what you would have paid for the 20-year term life insurance. There is also the risk that they may no longer be eligible for insurance if there have been significant changes in health circumstances.

Strategies to Optimize a 10 Year Term Insurance Plan

If 10 Year Term Insurance is your choice based on affordability, there are several options to optimize your insurance plan.

Firstly, by adding a renewable term life insurance policy this gives you the ability to renew your 10-year term policy without medical qualification. So, if there are any unexpected changes in your health over the initial 10 years, this won’t affect your premium. However, it should be noted that this may increase your premium for the initial 10-year term. Yet, they are likely to still be lower than the 20-year term insurance.

Another option is to renew prior to the expiration of the original policy. The earlier you renew, the more likely to get a better premium than you would at the end. This is largely due to age risk factors. This is a great option if you currently cannot afford the 20-year term premiums initially but perhaps have this option a few years into your 10-year term.

Lastly, add a convertible term life insurance policy prior to the expiry of your term life insurance. This allows you to convert to whole life insurance. Moreover, this waives the medical qualification requirement. This mitigates the risk that you may no longer be eligible for insurance if there have been significant changes in health circumstances. This may increase your premiums.

Determine the Best Term Life Insurance for You

When it comes to term life insurance, there is no one size fits all. Firstly, establish what you would need to ensure financial stability for your dependents if you were gone. How many dependents do you have and how long would you need to support them? Do you have other long term financial obligations such as a mortgage? This could be challenging for your dependents to support after your death.

Secondly, determine your age and how long you best estimate having these obligations. If your dependents are nearing the age of financial independence and your mortgage is nearing the end of its term, a 10-year term life insurance plan may be best for you.

Lastly, the cost of term life insurance may impact your decision. If you are unable to pay the higher premium of the longer term, the 10-year term insurance plan may be better for you. However, be sure to factor in a long term perspective when considering the length of term.

Life Insurance is a big decision, with lots of factors to consider. Finding solutions to meet your individual requirements is essential to ensure you have the coverage you need. We strongly advise you to make well-informed decisions by seeking advice. Billyard Insurance Group can provide you with no cost advice and will help you shop for your life insurance solution. Click here to contact an advisor today.