What is Critical Illness Insurance?

Friday, 2 November 2018

What is Critical Illness Insurance & Why Do I Need It?

Do you need critical illness insurance? Canadians have one of the longest life expectancies in the world. This is thanks to medical advances which have significantly improved the survival rates of people who suffer critical illnesses in their lifetime. These critical illnesses include cancer, stroke and heart disease. However, the scary reality is that the development of critical illness is a real concern among Canadians.

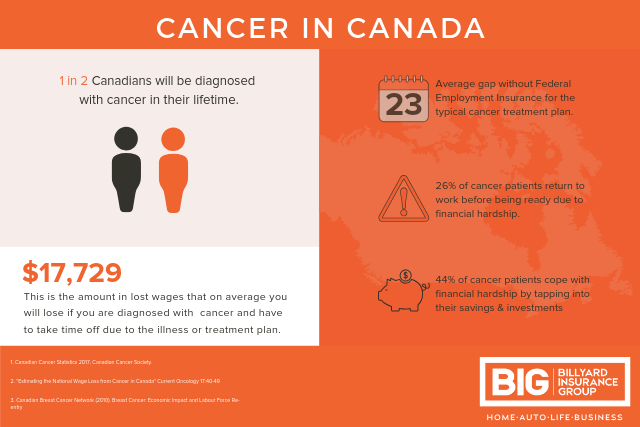

9 out of 10 Canadians have at least one risk factor for coronary heart disease or stroke. There are already over 400,000 people who have suffered the effects of a stroke and this number is expected to increase significantly. Cancer is also a critical illness with very high prevalence. In fact, 1 in 2 Canadians will be diagnosed with Cancer in their lifetime.

Most people are optimistic in that they don’t think critical illness will ever personally affect them. The statistics suggest otherwise, and critical illness can happen at any time. Recovery from a critical illness often comes with significant financial costs. In Ontario, employment insurance only covers you for 15 weeks which leaves a gap of about 23 weeks for an average cancer treatment plan. 44% of cancer patients cope with the financial hardship by using their savings and investments. Furthermore, almost a quarter of cancer patients return to work before they are ready. This means that the financial obligations are impacting your recovery time.

Critical illness should not cause you to have to dive in to your hard-earned savings and investments to meet your financial obligations. More importantly, your finances should not be the reason that you do not get the recovery time you need. The solution? Critical illness insurance can safeguard your family and protect your finances in the unfortunate event of a critical illness diagnosis.

How Does Critical Illness Insurance Help?

Critical illness insurance offers the financial support to cover the costs that are associated with a critical illness. If you become ill with an illness covered by your policy and you’ll be eligible to receive a lump-sum cash payment after the waiting period defined in your policy. You are free to decide how to spend the money, whether this be for treatment costs or to cover financial obligations.

When looking at critical illness insurance, it is important that you check your policy to make sure it covers what you need. Typically, it covers the four most common life-threatening conditions: cancer, heart attack, stroke and coronary artery bypass. Each policy differs in what other type of illnesses are covered whether by full or partial payout. We recommend you seek advice on what type of coverage you require and for which illnesses you want to be covered. Our team at Billyard Insurance Group can help with this.

Critical illness insurance can help you:

- Reduce debt and other financial concerns while you cope with your illness

- Replace any reduced or lost income for you and your spouse (if they take time off to be your caregiver or come to treatments with you).

- Bring in caregivers to help at home

- Choose new medical treatments and medications not covered by private or government health insurance plans

- Shield your financial plan including savings & investments

- Protect children or grandchildren with their own insurance coverage that they can have for life

How much does Critical Illness Insurance Cost?

The cost of critical illness insurance varied based on your individual circumstances and the type of plan you choose. When determining your premium your insurance will look at individual factors such as gender, age, smoking status and medical history. Then the coverage you choose, and the type of plan will determine how much your insurance will cost.

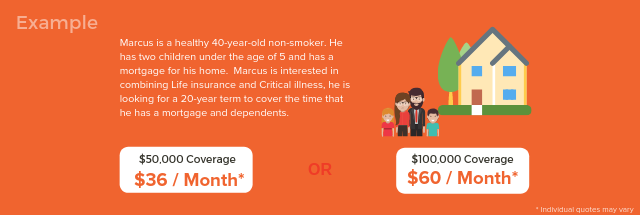

For example, Marcus is a healthy 40-year-old non-smoker. He has two children under the age of 5 and has a mortgage for his home. Looking at his options, he can choose to purchase a critical illness policy that goes up to the age 75 or can also purchase a plan to supplement his Term Life Insurance policy. He also has the options of two levels of coverage. The simple plan covers heart attacks, stroke and cancer or higher coverage which covers approximately 25 illnesses depending on the insurance company.

Marcus is interested in combining Life insurance and Critical illness. He is looking for a 20-year term to cover the time that he has a mortgage and dependents. Typically, critical illness insurance should cover 1-2 years of salary. For the higher coverage (25 illnesses), Marcus would be looking at either $36 per month for $50,000 coverage or $60 per month for $100,000 coverage.

Finding out you have a critical illness is a life changing moment. Take away the stress of financial burdens by ensuring you are protected by insurance. Billyard Insurance Group can provide you with no cost advice and will help you shop for your critical illness insurance. Contact an advisor today.