Ready to start?

Oakville drivers can save an average of $300 on insurance with BIG.

Hit the Roads of Oakville with Confidence

With access to major roadways like the QEW, Highway 403, and Dundas Street, Oakville offers a scenic and convenient experience for drivers. Known for its picturesque waterfront, lush parks, and lively downtown, there is always something beautiful to see and explore in this charming Halton Region town. While traffic in Oakville can occasionally be heavy during peak hours, the town’s well-maintained roads and scenic routes make getting around manageable.

Whether you are commuting to work, dropping the kids off at school, or going out for a leisurely drive, having reliable auto insurance in Oakville is essential to protecting yourself and your vehicle. If you are looking for the best car insurance in Oakville, a BIG broker can help you in your search and offer expert advice to ensure you’re getting the right coverage for your needs.

Join the Hundreds of Thousands Who Have Trusted BIG

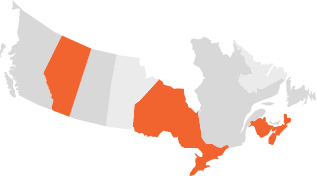

National Insurance Brokerage

Finding the best rates and coverage for Canadians in:

- Alberta

- Nova Scotia

- New Brunswick

- Ontario

Professional Service

Our team of experienced brokers will provide outstanding customer service and are dedicated to helping you find affordable auto insurance quotes in Oakville.

Access to a Variety of Insurance Providers

A Guide to Requesting Your Quote for Car Insurance in Oakville

Compare rates and explore your coverage options by following these steps:

Complete Our Quote Form

In this first step, we’ll need you to provide various details such as your address, age, driving record, vehicle information, and previous insurance coverage. This will help us better understand your situation and needs.

Compare and Customize

Shortly after you submit your information, a BIG broker will contact you to assess your quotes, discuss your coverage options, and offer advice to help you make an informed decision when crafting your policy.

Submit Your Application

After you and your broker have customized your policy, you’ll be sent a digital insurance application. Simply sign your application and you’ll be ready to hit the roads of Oakville as soon as possible.

Find an Oakville Brokerage Near You

Oakville

214-515 Dundas St. W.

Oakville, ON L6M 1L9

Frequently Asked Questions About Oakville Auto Insurance

The cost of vehicle insurance in Oakville is different for everyone and depends on several factors, such as your age, gender, driving experience, vehicle, and selected coverage. Your address, driving record, and insurance history will also play a part in determining your premium.

No, you cannot legally drive without car insurance in Oakville, or Canada for that matter. Each province has a minimum required level of insurance that all drivers must possess. If you drive without coverage, there could be severe consequences, such as vehicle impoundment, hefty fines, and licence suspension.

When compared to Toronto and other parts of the GTA, Oakville auto insurance is typically more affordable. However, rates can still vary based on factors that are unique to your situation - making it essential to shop around for the best rates.

Exploring your options is simple and convenient. Simply request an online insurance quote for Oakville on our website, and you can compare the best rates from our trusted insurance providers.

Whether you are in the process of buying your first vehicle, considering an upgrade, or want to buy another vehicle for your family, you should always request a quote before buying a car. This process is free and can help you find affordable car insurance options in Oakville before making a final decision on your purchase.

Having the right information on hand can make the process smoother. Be ready to provide your postal code, details about your vehicle (including its year, make, model, whether it has winter tires, and whether it's leased, financed, or owned), as well as your average commute distance and annual kilometres. You'll also need to share your driving history, including licence information, years insured, current insurance provider, and any claims or tickets. Don’t forget to include your contact information so a BIG car insurance broker in Oakville can touch base to discuss coverage options.

There are several ways to secure more affordable auto insurance in Oakville. Bundling your insurance policies, installing winter tires, reducing your mileage, and maintaining a clean driving record can all help lower your premium. Be sure to ask a broker if any of these options can help you save.

Your car insurance coverage in Oakville will begin as soon as possible. If you need coverage by a specific date, let your BIG broker know so you can avoid any gaps in coverage.

Top Factors Impacting Car Insurance Costs in Oakville

Several factors come into play when determining car insurance costs in Oakville. Insurance providers evaluate these aspects to assess your risk as a driver and the likelihood of filing a claim. Knowing these key factors can help you navigate your options and secure the right coverage at a competitive price.

Your postal code in Oakville plays a significant role in setting your car insurance rates. Insurers consider factors like traffic patterns, crime rates, and local accident statistics to determine the level of risk associated with your area. Living in a lower-risk neighbourhood may help reduce your premiums.

Certain personal details, including your age, gender, and marital status, affect how much you pay for car insurance. Younger drivers often face higher rates due to their inexperience, while older or married drivers may enjoy more favourable premiums.

Your driving history is a crucial factor in determining your insurance rates. Having a clean record shows insurers that you are a responsible driver, often leading to more affordable premiums. Conversely, frequent infractions or collisions may result in higher costs.

A continuous history of insurance coverage with no at-fault claims can show providers that you are responsible, making you less of a risk to insure. That said, having multiple claims might lead to increased premiums.

The car you drive matters when it comes to insurance costs. Vehicles equipped with advanced safety features or high-reliability ratings generally come with lower premiums. However, cars that have expensive repair costs, have high theft rates, or lack safety features can drive up your insurance costs.

The more you drive, the more you are exposed to potential accidents, which can increase your insurance premiums. Drivers who have long commutes or take frequent road trips might face higher rates than those who drive less often.

The level of coverage you choose for your insurance policy directly impacts your rates. Generally, selecting more coverage leads to higher premiums because the insurer takes on greater potential risk by providing protection for a wider range of damages.

How to Save On Car Insurance in Oakville

Looking for the best coverage at the best price? Here are some tips that can help you get the best of both worlds and save on auto insurance !

Work with a BIG Broker

A BIG broker in Oakville is your go-to for expert and unbiased advice. They can compare quotes from top insurance providers and help you build a policy that offers affordability and coverage tailored to your needs.

Bundle Your Policies

Combining your auto insurance with other policies like home insurance is a great way to unlock discounts. Bundling with the same provider can save you money and make managing your insurance more straightforward.

Install Winter Tires

Like many cities in Ontario, Oakville winters can be icy. However, installing winter tires not only improves safety - it may also qualify you for insurance discounts. If you use winter tires, be sure to ask your broker if you’re eligible for a reduced premium.

Maintain a Clean Driving Record

Safe driving pays off. Drivers with clean records typically receive lower premiums since they are considered lower risk. Avoiding traffic violations and accidents can help keep your rates affordable.

Explore Discount Opportunities

From discounts for seniors and good students to savings for installing anti-theft devices or parking in your garage, insurers provide many opportunities for clients to lower their rates. A BIG broker can help you identify and secure these savings.

Drive Your Car Less

Reducing your annual mileage may lower your insurance costs. If you can cut back on the amount you drive, your insurers might offer a more competitive rate. Talk to a broker to learn more about this option.

The Latest

Check out our latest blog posts on all things auto insurance…