Ready to start?

Peterborough drivers can save an average of $300 on insurance with BIG.

Drive with Confidence in Peterborough

Peterborough offers a blend of urban charm and outdoor adventures, making it an ideal place for drivers to explore. Whether you're navigating Lansdowne Street’s busy shopping district, taking a scenic drive along Highway 115, or heading out for a day by the Otonabee River, reliable car insurance is a must. Protect yourself and your vehicle so you can enjoy the freedom of the open road while staying prepared for the unexpected.

Join the Hundreds of Thousands Who Have Trusted BIG

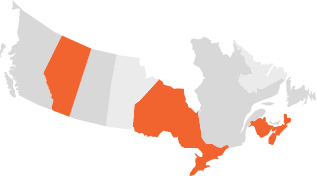

National Insurance Brokerage

Finding the best rates and coverage for Canadians in:

- Alberta

- Nova Scotia

- New Brunswick

- Ontario

Professional Service

Our team of experienced brokers will provide outstanding customer service and are dedicated to helping you find affordable auto insurance quotes in Peterborough.

Access to a Large Array of Trusted Insurance Partners

How to Get a Custom Auto Insurance Quote in Peterborough

Explore your options and secure a car insurance policy by completing these steps:

Share Your Information

Provide details such as your postal code, driving history, and vehicle type to receive personalized car insurance quotes in Peterborough.

Customize Your Coverage

A BIG broker will walk you through your options, adjusting coverage and deductible amounts to suit your needs while identifying potential discounts.

Submit Your Application

Once you're happy with your policy, sign the necessary documents so your coverage can begin promptly.

Find a Peterborough Insurance Brokerage Near You

Peterborough

1600 Lansdowne Street W, Unit 2

Peterborough, ON K9J 7C7

Common Questions About Car Insurance in Peterborough

Peterborough car insurance rates can vary and depend on factors such as:

- Your age, gender, and marital status

- The type of vehicle you drive

- Your driving history

- How often and how far you drive

- Where you live in Peterborough

Driving without insurance is against the law. Doing so can result in fines, licence suspension, or even vehicle impoundment.

Simply request an online insurance quote for Peterborough on our website, and a broker will guide you through the process of selecting the best coverage for your situation.

Car insurance rates in Peterborough are typically more affordable compared to other Ontario cities. However, no two policies are the same. Some people pay more than others. It all depends on your situation and the coverage you choose

Absolutely! You can request a car insurance quote for Peterborough before purchasing a vehicle. Simply provide details such as the year, make, and model of the cars you're considering to understand how much it will cost to insure.

To get a personalized quote for car insurance in Peterborough, be prepared to provide:

- Your postal code and contact information

- The year, make, and model of the car you want to insure

- Whether your vehicle is leased, financed, or owned

- If you use winter tires

- Personal details, such as your age, licence and insurance history, gender, and marital status

- Work with a car insurance broker in Peterborough to compare rates

- Bundle your home and auto insurance policies

- Install winter tires for enhanced safety

- Follow safe driving practices

- Maintain a clean driving record

- Reduce your annual mileage

Your policy can start as soon as your application is approved. Be sure to let your broker know of your desired start date to ensure seamless coverage without any interruptions.

Factors that Influence Your Peterborough Vehicle Insurance Rate

Determining auto insurance rates in Peterborough is complex and involves many different factors. Generally speaking, the perceived level of risk associated with insuring you is one of the biggest. When seeking a quote, consulting a broker proves invaluable and is crucial to ensuring sufficient coverage that aligns with your needs. It’s important to be transparent and honest when requesting a quote, as any discrepancies in information can lead to issues when filing a claim.

This important detail helps insurance providers determine the level of risk associated with insuring your vehicle. In Peterborough, factors such as crime rates, traffic patterns, and accident statistics in your neighbourhood can influence your car insurance premium.

Your personal details, such as age, gender, and marital status, significantly impact your car insurance rates. For example, younger drivers often pay higher premiums, while married individuals or seasoned drivers may qualify for better rates.

The length of time you've been driving and the quality of your driving record heavily influence your car insurance rates. Experienced drivers are typically rewarded with lower premiums, while new drivers or those with a history of accidents or traffic violations may face higher costs.

This provides insurers with insight into how often you’ve filed claims in the past. Frequent claims or a history of at-fault accidents can lead to higher premiums, as they indicate a greater risk to insure.

Insurance providers will review the make, model, age, and features of your vehicle to determine its risk level. Owning a car with high repair costs or theft rates might result in increased premiums, while safer or less expensive vehicles might lead to lower rates.

The amount you drive each year plays a role in determining your insurance rate. Higher annual mileage increases the likelihood of accidents, leading to higher premiums

The level of coverage you choose directly impacts your car insurance rate. Opting for higher coverage limits, additional protection like comprehensive or collision coverage, and lower deductibles typically results in higher premiums. Conversely, selecting minimal coverage or higher deductibles can help lower your monthly costs.

Tips for Finding Affordable Car Insurance in Peterborough

Looking to save on auto insurance? Getting affordable car insurance quotes in Peterborough doesn't have to be difficult. Here are some tips to help you secure more favourable rates.

Discuss Your Options with an Insurance Broker

A BIG broker can guide you through the process of selecting the right car insurance in Peterborough. They’ll compare quotes and tailor a policy that meets your needs while helping you find the most competitive rates.

Unlock Savings When You Bundle Policies

Bundling your auto insurance with other policies, such as home or renters insurance, is an effective way to cut costs. Many insurance providers offer multi-policy discounts, making it an easy and cost-efficient way to simplify your coverage.

Prioritize Safety with Winter Tires

Installing winter tires is an easy way to improve your vehicle’s safety during Peterborough's snowy months. Taking this proactive step often results in discounts, as it ensures better traction and reduces the risk of accidents on winter roads.

Be a Responsible Driver

Obeying speed limits, staying focused on the road, and driving attentively can help prevent accidents and keep you and others safe. This not only reduces risk but can help maintain a clean driving record - which can lead to lower insurance premiums.

Ask About Discounts

Your broker can inform you about a variety of discounts you may qualify for, such as being a member of certain organizations, professional associations, or alumni groups. Be sure to ask your broker if you can take advantage of these opportunities to save.

Consider Other Forms of Transportation

Driving fewer kilometres each year decreases your risk of accidents, making you a lower-risk customer in the eyes of insurers. When possible, consider using public transit, carpooling, or rideshare options to reduce the amount you drive.

The Latest

Check out our latest blog posts on all things auto insurance…