Ready to start?

St. Catharines drivers can save an average of $300 on insurance with BIG.

Request a Quote for Car Insurance in St. Catharines Today

Getting around St. Catharines is easy and convenient, thanks to its well-connected roadways. Major routes like the Queen Elizabeth Way (QEW) link the city to Toronto, Niagara Falls, and Buffalo, while Highway 406 provides access to downtown St. Catharines, Thorold, and Welland.

Whether you're commuting to class at Brock University, heading to Port Dalhousie for a lakeside stroll, or visiting the FirstOntario Performing Arts Centre, having the right car insurance is important. At Billyard Insurance Group, we understand your unique driving needs and are here to help you find the best coverage to keep you protected on the road.

Join the Hundreds of Thousands Who Have Trusted BIG

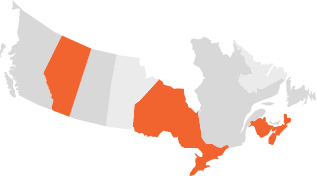

National Insurance Brokerage

Finding the best rates and coverage for Canadians in:

- Alberta

- Nova Scotia

- New Brunswick

- Ontario

Professional Service

Our team of experienced brokers will provide outstanding customer service and are dedicated to helping you find affordable auto insurance quotes in St. Catharines.

Access to a Large Array of Trusted Insurance Providers

How to Request Car Insurance Quotes in St. Catharines

Compare rates for the best car insurance in St. Catharines by completing the following steps:

Complete Our Form

Start by entering details like your postal code, age, vehicle information, driving history, and insurance information into our quote form so we can pull the best options for your situation.

Choose Your Coverage

After requesting your online insurance quote for St. Catharines, a BIG broker will connect with you to create a personalized policy to ensure your coverage meets your needs.

Submit Your Application

Once the details of your policy have been finalized, you will receive a digital insurance application. Simply sign the document so you can secure your coverage as soon as possible.

Find a St. Catharines Brokerage Near You

St. Catharines

101 Eastchester Ave

St. Catharines, ON L2P 2Y9

Frequently Asked Questions About Car Insurance in St. Catharines

The cost of auto insurance in St. Catharines depends on several factors, including your driving history, age, type of vehicle, and coverage options. Other considerations, like where you live in the city and how frequently you drive, can also impact your premium. Since every driver's situation is unique, the best way to find out how much you'll pay is to get a personalized quote.

Yes, auto insurance is mandatory in St. Catharines. Driving without it is a serious offence that can result in hefty fines, licence suspension, and even having your vehicle impounded. All drivers are required to carry a valid insurance policy that meets Ontario’s minimum coverage standards.

Auto insurance rates in St. Catharines can vary. Local factors such as traffic patterns, crime rates, and the number of claims filed in the area all influence premiums. A car insurance broker in St. Catharines can help you compare quotes from multiple providers so that you don’t miss out on the best rate available.

Simply request a personalized quote for auto insurance through our website or contact a BIG broker to receive guidance in selecting a policy that best suits your needs.

Insurance rates can vary significantly depending on the make and model of the car you’re considering. Getting a quote beforehand helps you understand the potential insurance costs and ensures you choose a vehicle that aligns with your budget. This way, you can make a more informed decision and avoid any surprises down the road.

You’ll need to provide your postal code, age, gender, and contact information, along with details about your vehicle and usage. Additionally, be prepared to share your driving history, including how long you’ve been licenced, years of insurance coverage, current provider, and any past claims or tickets.

From maintaining a clean driving record to bundling multiple insurance policies, there are many ways that you can lower the cost of car insurance. A BIG broker can help you identify any opportunities that offer these savings.

Our brokers will work to have your policy start as soon as possible. If you need insurance by a specific date, let your broker know so that you can avoid any delays or gaps in coverage.

How St. Catharines Vehicle Insurance Rates Are Calculated

There are many factors that influence the price of car insurance in St. Catharines, resulting in premiums that are unique to each driver. Here’s how they come together to determine your rate.

Insurance providers use your address and analyze local factors like traffic density, crime rates, and the frequency of accidents to determine the likelihood of you filing a claim. If you live in a neighbourhood with more favourable conditions, you could benefit from better rates.

Younger drivers, especially those under 25, generally pay higher premiums due to a greater likelihood of accidents. Male drivers may also face higher rates, as statistics show they are more prone to risky driving behaviours. Conversely, married individuals often benefit from lower premiums, as they are viewed as more cautious drivers. These personal factors help insurers gauge risk and determine your insurance costs.

Generally speaking, the more driving experience you have, the better. This is especially true if you can keep your driving record free of any traffic violations or at-fault accidents.

Similarly to your driving history, the longer you have been insured and free of any at-fault claims, the more likely you are to get a better rate. However, if you have filed multiple claims within a short period of time, your rates might be higher.

The make, model, and age of your vehicle can significantly affect your insurance rates. Newer cars, luxury models, and sports cars often come with higher premiums due to their higher repair costs and theft rates. In contrast, owning used cars, basic models, and those with strong safety features can result in lower insurance costs.

The amount you drive can influence your car insurance rates, as higher mileage typically increases your risk of being involved in an accident. If you have a long daily commute or frequently drive long distances, your premium may be higher.

While there is a basic minimum of insurance that you are required to have as a driver, you can also choose to enhance your policy with optional add-ons. Opting to include these coverages might cause your rates to increase, but will offer more protection to you and your vehicle.

How to Lower Your Car

Insurance Costs in St. Catharines

Looking for ways to reduce your car insurance premiums in St. Catharines?

Here are some tips that could help you save money without sacrificing necessary coverage.

Work with an Insurance Broker

Insurance brokers will offer unbiased, expert advice during your search for auto insurance. They will help you compare quotes from different providers so that you don’t overpay for unnecessary coverage.

Bundle Your Insurance Policies

Combining your car insurance with other policies, such as home or condo insurance, can lead to savings. Many insurers offer discounts to clients who bundle, making it an effective way to secure lower premiums.

Install Winter Tires

Winter conditions can be unpredictable. Equipping your vehicle with snow tires is a precautionary step that not only boosts safety but can also help you unlock savings on your auto insurance policy.

Maintain a Clean Driving Record

A clean driving history can have a positive influence on your insurance rates. Practicing safe driving habits can help you avoid car accidents and receiving tickets - which can show insurers that you are a low-risk driver.

Look Into Discounts

There are all kinds of discounts that can result in you paying less for car insurance. Maybe you recently installed an anti-theft device in your car, or maybe your teenager just completed driving lessons. Ask a broker if there are any discounts that you qualify for!

Cut Back on Driving

Limiting the amount you drive can help lower your insurance premium. Whether you carpool with a colleague to work, take public transit more often, or combine errands into fewer trips, driving less lowers the risk of an accident and can lead to potential savings.

The Latest

Check out our latest blog posts on all things auto insurance…