Is Now a Good Time to Invest?

Wednesday, 11 May 2022

In the wake of rising interest rates and market volatility, you may be wondering, “Is now a good time to invest?” Many people will talk about timing the markets – investing when we’ve hit rock bottom and selling off when you’ve made a profit during the recovery. This approach, while it may seem logical, is complicated by many other factors and may not be the most effective. When investing, there are so many variables that are unique to your personal situation that you should review with a financial advisor to help you build the best investment plan for your individual needs. In this blog, we will talk about some general personal factors that can determine if it’s a good time to invest to help you evaluate if now is a good time for you to invest.

Is Now a Good Time to Invest: Let’s Get Personal

When considering investing, your personal circumstances will influence whether now is a good time to invest, as well as the current conditions in the financial markets. You may have been told that the sooner you invest, the more your money will grow in the long term, which is absolutely true! The best time to start investing is now, but consider these personal situations before you start as there are some exceptional circumstances where it’s better to wait.

- Do you have any high-interest debt?

If you have any high-interest debt it’s advisable to use any extra cash to pay off that debt first before investing. Debt interest rates are usually much higher (ie. credit cards at 19.99%) and will cost you more than any gains you may make in the short term from investments. Tackling high-interest debt first will benefit you more in the long run. If you have small/low-interest debts and you are able to make regular payments, it’s a great time to start building an emergency fund and investing with what room you have in your budget. Even if you’re starting small, it’s a great time to start!

- Make room in your budget to contribute to investments

When you look at your budget, consider all your expenses and categorize them as a ‘need’ or ‘want’. Are you willing to sacrifice that $5 coffee or weekly takeout occasionally to save toward investments? Even if it’s $20 a month, the sooner you start, the more your money grows! We advise setting up a pre-authorized payment to come out each payday for contributions towards savings and investment so that you won’t spend it elsewhere. If you have a secure financial position, have a higher risk tolerance, and have long-term financial goals, now is a good time to invest by taking out a low-interest loan and investing it while the market is down. In the long-term the markets will bounce back and, as long as you don’t take that money out for 20-30 years, you can stand to make a great profit.

- When will you need the money you’ve invested?

If you do have extra cash available or room in your budget to start investing, are you going to need that money in the next few years for a known expense? If you know you’ll need that cash for your tax bill coming due, or tuition, etc., putting cash in the market for a shorter term in hopes of a quick profit isn’t investing – it’s gambling. It’s unwise to invest if you know you will need that money in the next year or two to cover upcoming expenses. A High-Interest Savings Account (HISA) or Guaranteed Investment Certificate (GIC) available to Canadians may offer a better solution for interest growth without investing in a volatile market.

- Do you have secure employment?

Job security is key to maintaining a healthy financial situation. If you are working a steady job and have your monthly budget under control, it’s a great time to get in touch with a financial advisor who you trust to talk about investing. If you’re in between jobs, or you have reduced hours due to COVID-19, it might not be the best time to put your savings on the line in investments. If you are a contract employee, self-employed, or a temporary worker and deal with seasonal layoffs, speak with a financial advisor to see what may work for your situation within your budget.

Is Now a Good Time to Invest? Determine Your Financial Goals and Risk Tolerance

Financial Goals are the personal, big-picture objectives you set for how you'll save and spend money and will help answer the question “is now a good time to invest.” Your financial goals can be things you hope to achieve in the short term (ie. down payment for a house, or vacation) or further down the road (savings for a child’s tuition, or retirement).

Your financial goals will help determine the type of investment you choose. There are several types of savings accounts or “money containers” that can be invested in a combination of stocks, bonds, ETFs, etc. that are selected to meet your preferred risk tolerance:

- Tax-Free Savings Account (TFSA)

- Registered Retirement Savings Plan (RRSP)

- Registered Education Savings Plan (RESP)

Risk Tolerance is a measure of how much variability in investments you are willing to withstand in your financial planning. A person’s age, investment goals, income, and comfort level all play into determining their risk tolerance.

Generally, a younger person saving for retirement or another long-term financial goal may be willing to endure a bit more fluctuation in the markets because it may result in a higher return long-term. This would be considered an aggressive risk tolerance. For those who are nearing retirement, or saving for a short-term goal, a more conservative risk tolerance would be better so that they can depend on those savings to have slow, consistent growth with minimal chance of loss when they need it in a couple of years.

Is Now a Good Time to Invest: Market Situation

The markets are always in flux, but they are particularly volatile due to current affairs and rising interest rates which have affected global markets. While we have seen governments raise interest rates to curb inflation and stocks begin to plummet, it is difficult to know if now is a good time to invest as we don’t know if we have hit rock bottom. The best ways to manage the situation are to make sure your investment portfolio is well-diversified, avoid emotion-driven financial decisions, and contribute consistently using a dollar-cost averaging approach, which is especially effective in a falling-market or recession situation.

Dollar-Cost Averaging is the strategy of spreading out your investment purchases, buying at regular intervals and in roughly equal amounts rather than investing in one lump sum. It can help you: avoid mistiming the market, take emotion out of investing, and help you think longer-term.

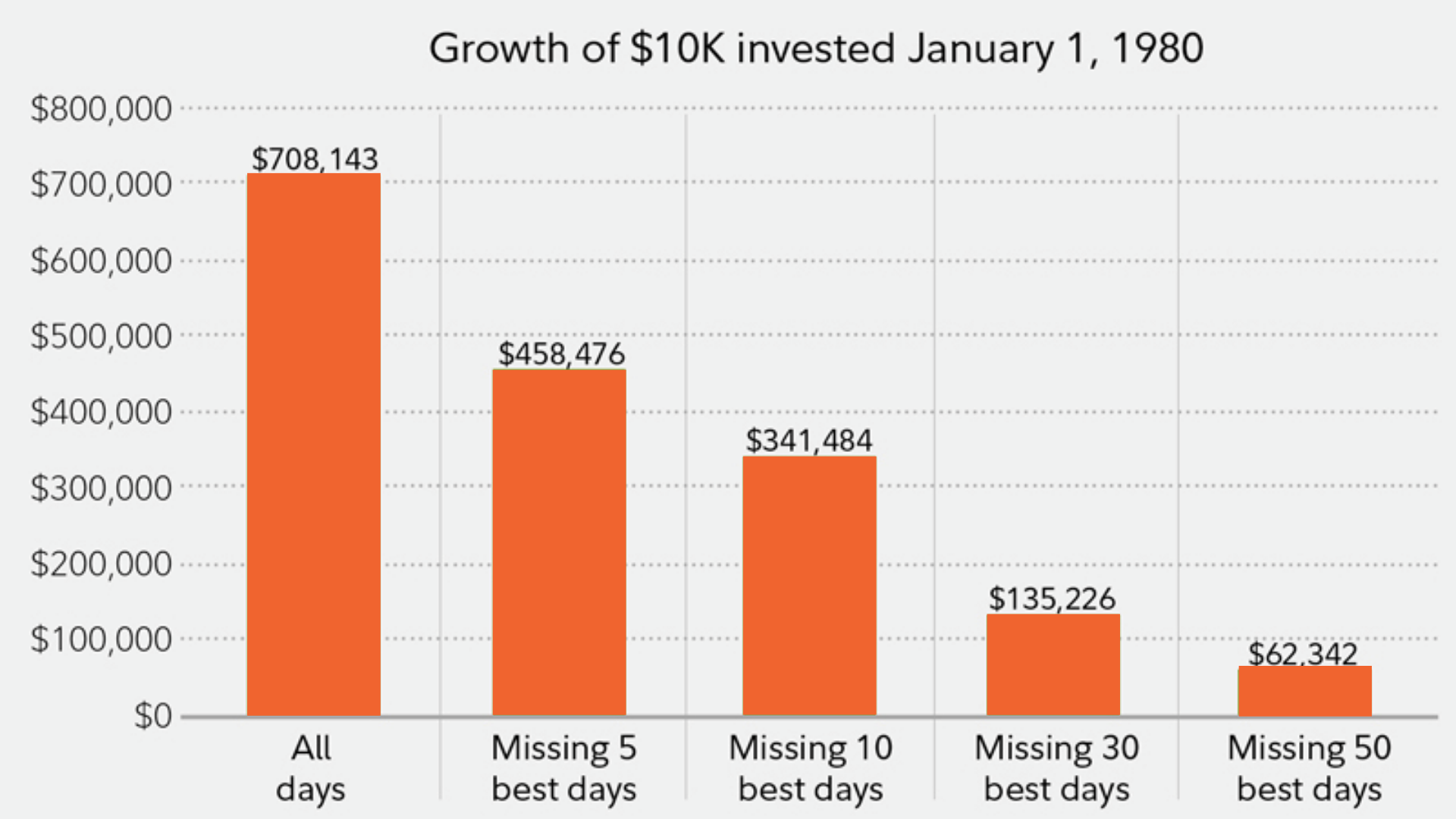

If you are currently invested in the market, now is NOT the time to sell. As history has demonstrated, markets ultimately recover from setbacks, large and small. The market will eventually recover and, as demonstrated below, keeping your money in investments now will result in better gains than if you took your money out now and tried to time the market.

At Billyard Insurance Group, we believe in helping you achieve your financial goals and life planning. Our trusted financial advisors are available to help evaluate your current financial situation and provide you with investment advice. They are able to cater to your specific needs, goals, and risk tolerance. Contact us today to start your journey to achieving your financial goals!

Author: Amy Legault